Corporate strategies to accelerate innovation through partnership, collaboration and competition

- Sirada Lorhpipat, CDI intern

- Mar 22, 2019

- 3 min read

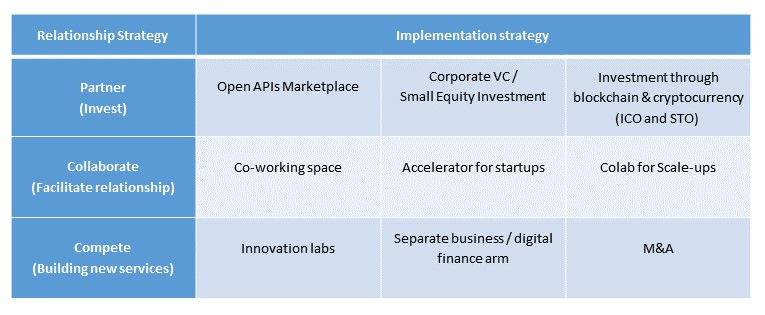

In today’s fast-moving digital era, corporates can keep up with emerging and rapidly growing startups through partnership, collaboration or competition. Corporates are adapting their strategies to groom and accelerate innovation according to market and technology trends, especially to support big regulatory changes such as open banking and PSD2. If corporates have sufficient budget and capability to execute multiple strategies, many have found great success through a hybrid approach by implementing a mix of strategies to acquire and utilize emerging technology. Different types of relationship and implementation strategies common adopted in the open banking era are summarized in the table below.

The implementation of open banking standards is popularizing new ways of partnership such as marketplace or platform approach, which involve building a walled garden style of marketplace per bank using open APIs and any fintech can register their service to be branded as part of the bank. To build strategic partnership with startups through partial investment, some incumbent banks have set up corporate venture capital (CVC) arm to provide capital support in exchange for 5 to 15 percent equity stakes. This approach can be effective if properly implemented because equity stakes give banks more incentives to support and groom startups. However, new ways of raising capital such as Initial Coin Offerings (ICO) and Security Token Offerings (STO) are emerging with wider adoption of blockchain technology and cryptocurrency, which may change the investment mechanism of many CVCs. While ICO allows corporates to participate in equity crowdfunding of startups through purchasing tokens or coins, STO operates more like IPO mechanism which allow corporates to purchase security tokens of startups during their offerings and trade these tokens to other investors. Investing in companies through STO is more secure and less prone to fraud than through ICO because security tokens are financial assets backed by companies’ tangible assets or revenues.

Incumbent banks can also engage in the fintech industry by facilitating relationships through co-working space, accelerator programs and colab programs. Many banks have sponsored or partnered with co-working spaces to foster the fintech community, making it easier to curate or reach out to potential fintechs. Some banks have gone a step further by running incubator or accelerator programs at these co-working spaces to provide startups working space, mentorship, professional network and resources for growth. However, corporates ha

ve encountered various flaws when working with startups through their accelerator programs as not all investment in early-stage startups turn out to be successful. Many incubators and accelerators have rebranded their programs into colab or refinery programs, which support scale-ups as well as startups to invest their resources in more mature companies with higher chance of being integrated with large enterprises.

Another way that incumbent banks can retain their shares in the market and prevent themselves from disruption is to compete in the fintech space through building or acquiring new services. Incumbent banks with large amount of resources and tech talents have ran internal innovation labs, aimed to generate ideas for new services and quickly bring these ideas to test in the market. However, many banks have found out that only a few ideas from innovation labs ended up being implemented and integrated with system due to conflict with internal bureaucracy, long testing cycle and many compliance procedure. Alternatively, some banks decided to launch separate entities or subsidiaries, providing digital banking services to compete with challenger banks. Launching a separate business unit helps to overcome complex integration issues due to leaner organizational structure and less legacy IT infrastructure, allowing banks to bring new products to market and scale the business more rapidly. If banks cannot build new services fast enough to gain competitive advantage, banks should consider acquiring competing startups or their technology instead. With stronger competition, experts predict that there will be more mergers and acquisitions happening between large incumbent banks and smaller players, which may drive some smaller banks out of business.